The Tarrant County Hearing Results are visually represented on a map of Texas.

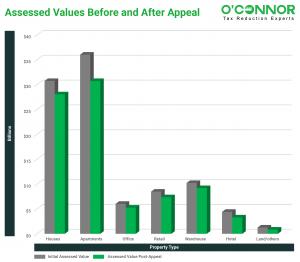

Tarrant County’s property values decreased for all types of properties after the protest hearings.

An Analysis of the Tarrant Appraisal District Hearing

By using the most recent hearing data from Tarrant County, O’Connor was able to reevaluate the advantages of pursuing appeals for county assessments.

DALLAS , TEXAS , UNITED STATES , November 16, 2023 /EINPresswire.com/ — According to the most recent data from September 2023, property owners in Tarrant County have managed to save in excess of $336 million due to the resolution of property tax disputes. This significant amount reflects the benefits received by those who chose to challenge their property tax assessments for the year 2023.

Property owners in Tarrant County have the right to lawfully contest the county assessment values since the Tarrant Appraisal District yearly offers real estate and business personal property market values for the residents of Tarrant County. This right holds true regardless of whether a value has gone up or down. Based on the original and current tax records given by Tarrant Appraisal District, this data was collected by O’Connor has been parsed to illuminate how appealing assessments on an annual basis can provide material benefits to property owners.

Prior to this, O’Connor predicted that as a result of Tarrant County property tax protests, the owners would save $278 million in total property taxes by 2023. It was foreseen by looking at the outcomes from the previous years as presented on Tarrant County Property Tax Trends. Now it is clear that they have saved more money on property taxes for Tarrant County than originally anticipated.

As of September 2023, the final revised savings for residential property owners in Tarrant County by way of property tax contests are close to $72.8 million. In response to 2023 tax objections, Tarrant Appraisal District has decreased valuations for 83,806 properties. Based on the completed assessment reductions totaling $32,205, there will be an average property tax savings per property of $870 based on a 2.7% tax rate without taking homestead exemptions into account.

According to the most recent statistics from September 2023, apartment complex owners in Tarrant County have retained their position as the top recipients of property tax reductions for the 2023 tax year. These complexes were initially valued north of $36 billion, but once apartment assessment challenges were resolved, the value was reduced to $30 billion. This decline in valuation has led to a $5.3 billion decrease in tax assessments. Apartment owners in Tarrant County can plan on saving a total of $143 million in property taxes, taking into consideration a tax rate of 2.7%. Based on completed appeals for 1,491 apartment complex property owners, the revised average for Tarrant County is a 14.7% drop from the original valuation, which corresponds to nearly $96,102 in property tax savings per apartment property settled in 2023.

With the most recent 2023 data available, Tarrant County’s land/other property type has now been involved in 4,075 hearings that have been resolved for 2023, with the current initial value of $1.25 billion being reduced to $832 million, making it the commercial property type with the largest percent reduction for 2023 at 33.7%. Considering a 2.7% tax rate, these commercial property owners have received $11.4 million in tax savings. This equals to $2,800 per tax parcel.

For hearings concluded in 2023 that resulted in reductions, the finalized 2023 hotel property tax savings include 343 hotels, with an average final property tax savings of $88,782 per hotel. With an initial value of $4.4 billion and a subsequent reduction of $1.12 billion, the current noticed value is $3.28 billion. At 25.6% for the tax year with reductions, hotel properties will have the second-highest average percentage decrease in hotel property tax protests.

The commercial office space appeals in Tarrant County have resulted in significant property tax savings. In 2023, a total of 2,221 appeals were finalized, resulting in a combined savings of $20.5 million. The assessed value of office properties has also been updated, decreasing from $6 billion to $5.2 billion, a reduction of $762 million for the 2023 tax year. These finalized office property tax protests have achieved a reduction percentage of 12.7%. With a tax rate of 2.7%, this reduction translates to an average savings of $9,271 per account.

Based on the latest available statistics as of September 2023, individuals who own properties in Tarrant County have successfully completed their tax appeal filings for the year 2023. As a result, the assessed value of 98,224 properties has been reduced from $97.1 billion to $84.6 billion. On average, this represents a decrease of 12.84%. Property owners who chose to protest their taxes have managed to save an average of $216,339 per property, taking in both residential and commercial structures.

The following three apartments received the highest 2023 property tax assessment reductions:

The Standard River District high-rise apartment complex’s property owner decreased their property tax assessment from $97.4 million to $66 million, a drop of $31.4 million or 32%, at 5200 White Settlement Rd in Fort Worth, Texas. Calculated using a 2.7% tax rate, this property tax assessment decrease lowers the owner’s property taxes by $848,430.

The initial property tax assessment for the owner of the Braden on Fifth apartment building decreased from $108 million to $82.8 million, a decrease of $25.3 million. The reduction will result in a savings of $683,714 for them in 2023. This apartment complex, which has 6 floors and 345 apartments when it was constructed in 2018, received a 23% property tax relief.

The Carter apartment building’s owner saw a $25 million drop in their original property tax assessment from $58.9 million to $33.9 million. In 2023, they will save $677,009 thanks to the reduction. This apartment building, which was built in 2022, has 4 stories and 276 apartments.

Even though the Tarrant Appraisal District only has 211 employees, they are nonetheless in charge of creating property assessments for the entirety of Tarrant County. It may be rewarding to go through the property tax procedure and obtain savings, as can be seen from the instances given above. There is no minimum property value requirement and participation is open to all Texas property owners, including residential and commercial.

The study’s data is derived from a comparison of Tarrant County’s initial 2023 tax year appraisal values with Tarrant County’s final amended 2023 tax assessments. The properties that were appealed without receiving a decrease are not included in this report.

About O’Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O’Connor, President

O’Connor

+1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

![]()

Article originally published on www.einpresswire.com as Property Tax Disputes For 2023 In Tarrant County Have Resulted In Savings Of $336 Million For This Tax Year