2024 Harris County Single Family % Increase by Value Range

2024 Harris County Single Family Assessment Increase

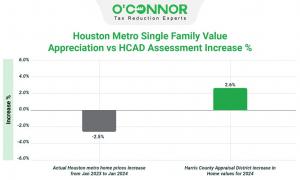

Houston Metro Single Family Value Appreciation vs HCAD Assessment Increase %

O’Connor has concluded that in the 2024 reappraisal, the Harris County Appraisal District increased residential property values by 2.6%.

HOUSTON, TEXAS, UNITED STATES, May 14, 2024 /EINPresswire.com/ — Luxury home values in Harris County rose by 9% in 2024

The most recent assessment of the Harris County Appraisal District, real estate market revealed notable shifts in residential property values spanning a range of price ranges. Property values exceeding $1.5 million exhibited a 9% growth, indicating that the luxury market category will keep continuing to rise. In a comparable way, there was a significant increase in the value of properties priced between $1 million and $1.5 million, with a 7% surge. In the opposite direction, properties with a market value below $250,000 experienced an overall decrease, reducing by $603 million from their value in 2023, an amount equivalent to a 0.8% reduction.

Harris County’s property values in 2024 saw varied fluctuations

Harris County saw significant fluctuations in property values in 2024. Overall, the total value of properties increased by 2.6%, reaching $408 billion from $397 billion. Notably, homes over 8,000 square feet, typically high-value properties, surged by an impressive 9.7%. Conversely, single-family residences under 2,000 square feet experienced the smallest increase, rising by just 0.7% from $125 billion to $126 billion, collectively.

HCAD’s Surprising Increase vs. Houston Metro’s Decreases

As per recent reports, the Harris County Appraisal District raised home values by an average of 2.6% during the 2024 property tax reassessment in the county. However, the Houston Metro source indicated a decrease of 2.5% from January 2023 to January 2024.

Harris County Tax Assessments Based on Year Built

During the 2024 property tax reappraisals conducted by the Harris County Appraisal District, homes constructed after 2001 in Harris County received slightly higher assessments compared to those built in other years. The assessed value increased from $178 billion to $185 billion, indicating a 3.5% surge. Conversely, properties constructed between 1961 and 1980 experienced the smallest growth in the housing market, with a modest gain of 1.1%. Overall, based on statistics from the Harris County Appraisal District, the value of houses in the county increased by 2.6%, categorized by the year of construction.

52% of Harris County Properties Saw Higher Sales Prices in 2024

In 2024, 48% of Harris County properties were overvalued by the Harris County Appraisal District. Research comparing 2023 house sales prices to 2024 property tax reassessments revealed that 52% of properties had sales prices at or below 2023noticed market value.

Highlights of HCAD’s 2024 Property Tax Revaluation

Property owners in Harris County are witnessing significant increases in property values across both luxury residential property and commercial sectors. Harris County reported stronger growth compared to the Harris metro area.

Appeal Your Property Values Each and Every Year

Texas property owners have a legal right and would be sensible to challenge the assessed value of their land, especially those in Harris County. Owners of both residential and commercial properties may support their claim that the assessed value is excessive with proof throughout the appeal process. Owners should seriously think about filing an appeal or hiring a property tax consulting firm since most property tax protests end in a positive way. . O’Connor has fifty years of expertise in real estate business and understands how to support the fight for reduction of residential and commercial properties. Moreover, they have the resources required to back their main goal of improving property owners’ lives by efficiently and lowering taxes.

About O’Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O’Connor, President

O’Connor

+ +1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

![]()

Article originally published on www.einpresswire.com as In The 2024 Reappraisal, The Harris County Appraisal District Raised Residential Property Values By 2.6%