Tax Binding Arbitrations & Lawsuits for Bexar County Properties

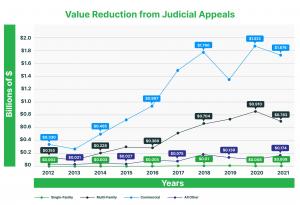

Value Reduction from Judicial Appeals

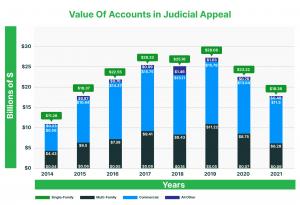

Value of Accounts in Judicial Appeal

O’Connor thoroughly examined property tax disputes in Bexar County.

AUSTIN, TEXAS, UNITED STATES , March 15, 2024 /EINPresswire.com/ — In addition to the administrative appeal process, Texas property owners are granted the option to extend their mission for fair and accurate property assessments. The means of which include binding arbitration, judicial appeals, and the State Office of Administrative Hearing. In this article, we will review the frequency and effectiveness of Bexar County owners who pursue these avenues to reduce their property taxes.

The number of Bexar County binding arbitration cases from 2014 to 2021 has soared by 449% and during the same time frame, judicial appeals are up by over 204%. In 2021, the total number of both binding arbitration and judicial appeals was 1,272. This trend of greater lawsuits to resolve property assessments is evident across Texas.

Bexar County Binding Arbitration Filings

In 2021, while Bexar County didn’t rank highest in the state for binding arbitration cases, with 258 cases, this is appreciably up from only 47 reported in 2014. Other Texas counties with high numbers of appeals escalating to binding arbitration are Harris Central Appraisal District, who reported the highest count statewide for 2021, with 5007 binding arbitration cases. Other counties with significant numbers of filings include Travis County with 558 cases, Dallas County with 508 cases, Galveston County with 374 cases, and Tarrant County with 357 cases.

Bexar County Judicial Appeal Filings

Bexar County ranks fifth among the top counties for judicial appeals. Harris County leads the state with 6,652 judicial appeals, followed by Dallas County with 2,027, Travis County with 1,654, Tarrant County with 1,307, and Bexar County with 1,014.

Bexar County judicial appeals filed in 2021 were at more than double the statewide level. Bexar County property owners filed judicial appeals for $18.3 billion of $223 billion of property valued by the Bexar Appraisal District. This is 18% of Bexar County value versus 7.5% of property subject to a judicial appeal statewide. Judicial appeals in Texas include property with a total value of $324 billion, out of a total of $4.335 trillion.

Bexar County Judicial Appeal Tax Savings

In Bexar County and across Texas, property owners have significantly boosted their property tax savings through judicial appeals. Bexar County property owners slashed their property taxes by $13.87 million in 2012. By 2021, this figure soared to $71.28 million, marking a staggering 413% increase. Statewide, Texas property owners experienced a substantial surge in judicial appeal property tax savings, jumping from $215.9 million in 2012 to $832.4 million in 2021, representing a 285% increase.

Binding Arbitration versus Judicial Appeals

Binding arbitration, applicable to properties valued at $5 million or less, demands a deposit of $450 or more, refundable (less $50) upon successful filing or prevailing during the hearing. It often bypasses discovery, which is beneficial in districts known for exhaustive paper discovery. In contrast, judicial appeals entail filing and service fees (approximately $375), legal expenses for counsel, and expert report costs. Unlike the protracted duration of judicial appeals (12 to 36 months), binding arbitration disputes are typically resolved within 6 to 9 months.

Value of Accounts in Judicial Appeal

Most property tax consultants and property owners are dissuaded from pursuing judicial appeals with a value of less than $20 million due to the high costs involved. In lawsuits involving single-family properties, the mean value is approximately $4.1 million in Texas and $2.57 million in Bexar County. In Texas, however, the mean assessed value of multifamily properties in judicial appeal accounts is $32.6 million, compared to $29 million in Bexar County. In Bexar County, the average value of commercial property subject to judicial review was $16.2 million in 2021.

O’Connor Aggressively Coordinates Judicial Appeals – Provides Turnkey Service

O’Connor oversees teams responsible for handling judicial appeals, working with clients, preparing expert witness reports on market value and unequal appraisal, and negotiating settlements. They cover all costs, including filing fees, legal fees, and expert witness fees, with clients only paying if their property taxes are reduced below the appraisal review board level in a judicial appeal. Unlike most competitors, O’Connor covers all costs for judicial appeals and is willing to coordinate appeals for commercial accounts valued over $750,000 and residential accounts over $1,500,000, well below the usual threshold. For properties valued below $1,500,000, O’Connor can pursue binding arbitration.

It’s important to note that O’Connor is not a law firm; instead of solely providing legal services, they coordinate and cover costs for attorneys, filing fees, tax consultants, expert witnesses, and staff coordination.

Are Property Tax Savings from Judicial Appeals Successful?

Annually, property tax savings through Bexar County Judicial Appeals vary between $250 million and $300 million. Unfortunately, many Bexar County property owners, despite being eligible for a judicial appeal, often cease after the appraisal review board (ARB) stage.

Tip: If you own commercial property in Bexar County valued at $750,000 or more, pursuing a judicial appeal or binding arbitration is likely to be advantageous.

O’Connor Handles Binding Arbitration

O’Connor handles every facet of binding arbitration cases, including covering the arbitration deposit and assuming the risk of losing it (ranging from $450 to $1,500). Unlike many property tax consultants, O’Connor takes care of the binding arbitration deposit for the property owner. Moreover, O’Connor manages the filing, negotiates settlements, and/or represents clients at arbitration hearings. Additionally, O’Connor prepares expert reports on market value and unequal appraisal. Clients incur no costs for pursuing binding arbitration unless their property taxes are reduced, in which case the fee is a percentage of the property tax savings.

Additional Reduction to Support Binding Arbitration

Engaging O’Connor for binding arbitration typically involves disputes ranging from $20,000 to $30,000. O’Connor covers the costs, and you only pay if your property taxes are further reduced below the level set by the appraisal review board. There are no flat fees or upfront costs involved.

What is SOAH?

SOAH, also known as the State Office of Administrative Hearings, provides a quasi-judicial option as an alternative to binding arbitration or judicial appeals. SOAH judges are tasked with resolving disputes involving various Texas licensees, such as brokers, appraisers, and barbers. Unlike binding arbitration, there’s no cap on the value involved, but there is a minimum requirement of $1 million set by the appraisal review board, along with a $1,500 deposit. This deposit is reimbursed if the case is settled and can be utilized to compensate a SOAH judge if the case advances to trial.

While SOAH filings across the state have stayed below 100, there’s a noticeable upward trend. SOAH is particularly fitting for certain scenarios. Unlike some judicial appeals where extensive discovery is emphasized by appraisal district attorneys, SOAH cases often involve limited discovery, allowing for a more focused discussion on market value and unequal appraisal arguments.

Should You File a Judicial Appeal or Use Binding Arbitration?

Post-ARB appeals are rare compared to initial protests, with approximately 27,000 cases annually, including both binding arbitration and judicial appeals, compared to 2,190,000 initial protests in 2021. Many property owners who stop at the ARB may miss out on potential savings, as a significant portion of appeals result in tax reductions below the ARB level. Appraisal districts are open to reviewing binding arbitration cases filed in good faith.

For cases where the disputed value exceeds $20,000 to $30,000 and is well-founded, pursuing binding arbitration is often advisable in many appraisal districts. Most districts prefer to resolve cases with solid evidence. For a free assessment of your post-ARB options, please call 713-290-9700.

Bexar County Appeals after ARB Exceeds Statewide Average

In 2021, including both binding arbitration and judicial appeals, there were 1,272 cases compared to the total number of initial tax protests, which amounted to 136,650 cases.

About O’Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O’Connor, President

O’Connor

+1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

![]()

Article originally published on www.einpresswire.com as Bexar County Property Tax Binding Arbitration and Lawsuits