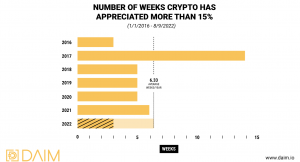

Number of weeks Bitcoin has appreciated by 15% or more

Bitcoin has a proven ability to generate excess returns relative to traditional assets.

NEWPORT BEACH, CA, USA, August 11, 2022 /EINPresswire.com/ — Bitcoin has the ability to generate positive, excess returns with a frequency that is unrivaled by traditional asset classes. According to Digital Asset Investment Management, DAIM, weeks where Bitcoin appreciated more than 15% are not a rare occurrence. Going back to 2016, BTC averaged at least 6 such weeks. Despite a rocky 2022 so far, the number of big weeks this year sits at 3. DAIM thinks we could reasonably expect 3 more by 2023. For traditional investors, taking a more passive approach, returns have been much more subdued. Despite the recent rally, the largest one week gain this year for the SP 500 was about 5.5%.

In fact, the index has only produced one 15% week going back to 2016. Its lower volatility has made for a smaller drawdown compared to Bitcoin but to gain that relative safety you will give up future upside. CEO Bryan Courchesne is excited for Bitcoin to have a strong finish to 2022.

“The fact that Bitcoin could be primed for multiple big weeks in a relatively short time period bodes well for Digital Asset investors”. As correlations between assets have increased, DAIM thinks that digital Assets have the clear advantage in a risk-on environment. Courchesne added “If the bottom is in and it’s only up from here then compounding with larger returns would make Bitcoin and other cryptocurrencies a more attractive investment vs traditional options”. DAIM is a pioneering Digital Asset only Registered Investment Advisor. You can learn more by visiting daim.io or emailing [email protected].

HQ

DAIM

+1 9492987582

email us here

Visit us on social media:

Twitter

LinkedIn

![]()

Article originally published on www.einpresswire.com as Big Weeks Ahead for Bitcoin

,

,