Neue Auctions’ online-only Art in Bloom auction, April 27th, will feature a Dale Chihuly-Italo Scanga art collaboration

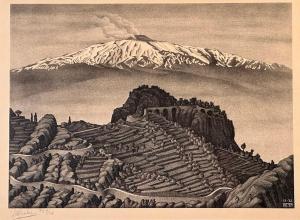

Lithograph on paper by Maurits Cornelis (M.C.) Escher (Dutch, 1898-1972), titled Castel Mola and Mount Edna, Sicily, signed, a rare early litho from the artist (est. $12,000-$18,000). Mixed media glass construction collaboration between Dale Chihuly (American, b. 1941) and Italo Scanga (Italian/American, 1932-2001), titled Pinball Machine (est. $15,000-$25,000). Early acrylic on canvas painting by Polish-born…